UK Inflation Impact and Interest Rate Predictions

The UK Inflation Impact directly affects interest rate predictions set by the Bank of England. Rising inflation often prompts policymakers to adjust interest rates to stabilize prices and control economic growth. Understanding these dynamics is crucial for businesses, investors, and consumers who are planning financial decisions in an uncertain environment.

Experts suggest that persistent inflation pressures may lead to incremental rate hikes, which can influence borrowing costs, mortgage rates, and investment returns. Monitoring economic indicators such as CPI (Consumer Price Index), employment data, and wage growth helps forecast how interest rates might evolve in response to inflationary trends.

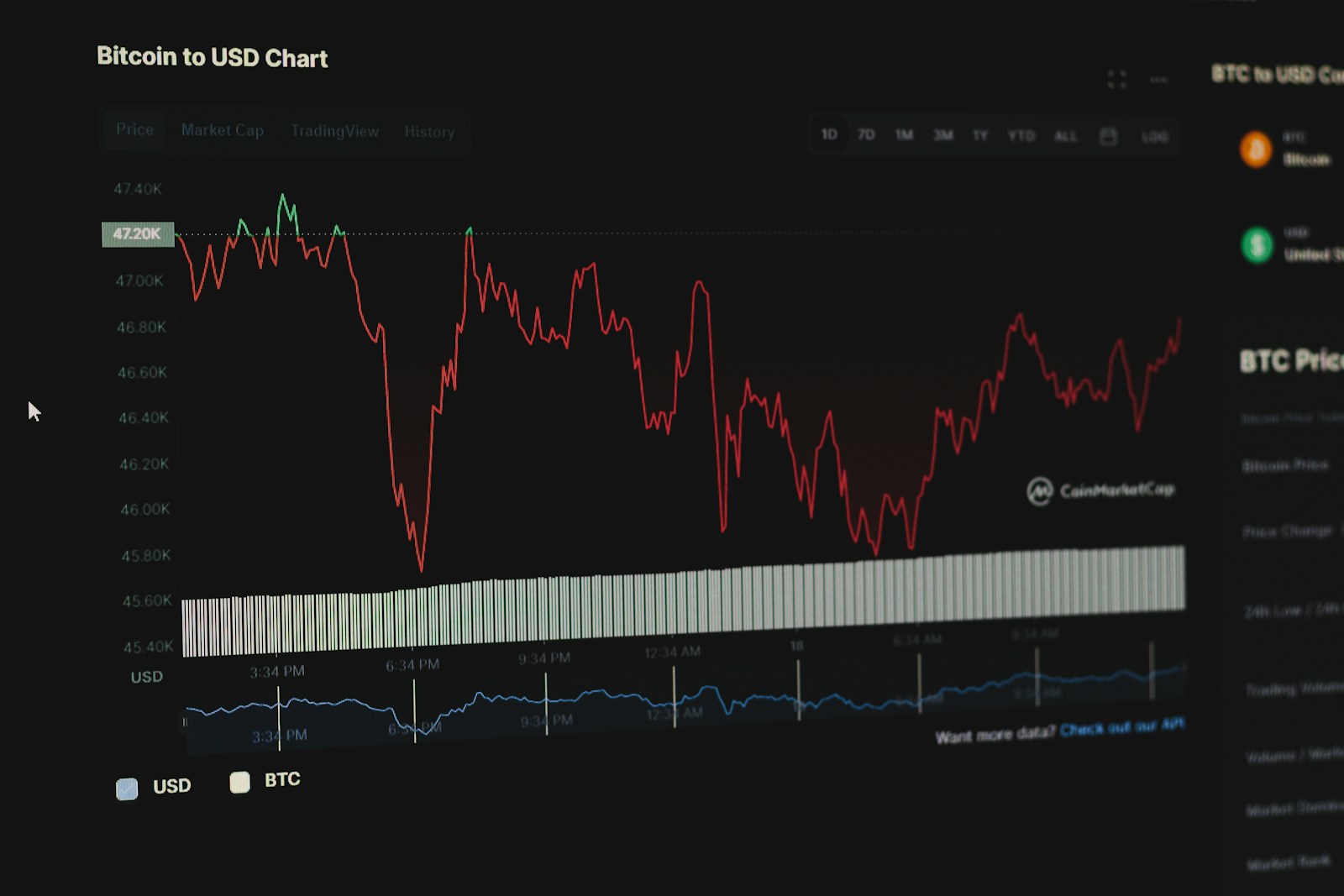

UK Inflation Impact on Financial Markets

Financial markets react swiftly to changes in the UK Inflation Impact. Equity markets, bond yields, and currency values can experience volatility as traders and investors adjust expectations. For instance, higher inflation may reduce the purchasing power of money, prompting shifts in investment strategies towards assets that provide inflation protection.

Market participants closely follow central bank announcements and expert analyses to anticipate rate changes. Understanding these reactions helps investors manage risk, optimize portfolios, and seize opportunities arising from shifts in interest rates influenced by inflation trends.

UK Inflation Impact on Consumer Behavior

The UK Inflation Impact also shapes consumer behavior. As prices rise, households may reduce discretionary spending, prioritize essential purchases, or seek better value alternatives. This change in consumption patterns affects retail sales, service demand, and broader economic activity.

Businesses must adapt by adjusting pricing strategies, managing costs, and anticipating shifts in demand. By closely observing consumer responses to inflation, companies can implement proactive measures that maintain customer loyalty and support long-term stability amidst economic fluctuations.

UK Inflation Impact and Business Investment

The UK Inflation Impact plays a crucial role in shaping business investment decisions. Rising prices can increase production costs, reduce profit margins, and affect the timing of capital expenditures. Companies often reassess expansion plans, project funding, and resource allocation to ensure that investments remain viable in an inflationary environment.

Businesses may adopt strategies such as cost optimization, hedging against price fluctuations, or renegotiating supplier contracts to mitigate inflation risks. Analyzing historical trends and consulting expert forecasts helps organizations make informed decisions that protect profitability and support long-term growth despite economic pressures.

Monetary Policy Response

Monetary authorities closely monitor the UK Inflation Impact to determine appropriate policy responses. Central banks, like the Bank of England, may adjust benchmark interest rates, implement quantitative easing, or use other tools to control inflation. These actions influence borrowing costs, liquidity in the financial system, and overall economic stability.

A well-calibrated monetary policy helps balance inflation control with economic growth. By understanding how central banks respond to inflation signals, investors, businesses, and consumers can better anticipate changes in the financial landscape and plan accordingly.

Global Economic Linkages

The UK Inflation Impact extends beyond national borders, affecting global trade, currency exchange, and international investment flows. As the UK economy interacts with global markets, changes in interest rates and inflation expectations can influence foreign investors’ decisions, import-export pricing, and cross-border financial strategies.

Global businesses with exposure to the UK market must remain agile, adjusting strategies to respond to economic signals. Monitoring international trends, currency fluctuations, and policy announcements enables companies to navigate the ripple effects of UK inflation while safeguarding competitiveness and operational stability.

Personal Finance Strategies

The UK Inflation Impact significantly affects personal finance decisions. Rising prices influence household budgets, savings behavior, and borrowing patterns. Individuals must evaluate their spending priorities, reduce discretionary expenditures, and consider inflation-protected investment options to preserve wealth and purchasing power in an inflationary environment.

Debt management becomes increasingly important as interest rates adjust in response to inflation trends. Mortgage holders, loan borrowers, and credit users must anticipate rate changes and assess repayment strategies carefully. Financial advisors often recommend diversifying assets, investing in inflation-hedged instruments, and maintaining an emergency fund to buffer against unexpected economic shifts.

Understanding inflation’s effects on personal finance empowers individuals to make proactive decisions. Monitoring price indices, staying informed on central bank policies, and leveraging expert insights enables households to navigate financial uncertainty effectively while safeguarding long-term stability.

UK Inflation Impact and Corporate Risk Management

Corporate entities are directly influenced by the UK Inflation Impact as they navigate operational, financial, and strategic risks. Inflation affects raw material costs, labor expenses, and supply chain pricing, which can erode profit margins if not managed proactively. Companies adopt risk management frameworks that include scenario planning, hedging strategies, and flexible pricing models to maintain financial resilience.

Dynamic monitoring of inflation trends allows corporations to anticipate potential disruptions, adjust procurement strategies, and optimize resource allocation. Executive teams rely on data-driven insights to balance cost pressures with investment priorities, ensuring that organizational objectives remain achievable even amid economic volatility.

Integrating comprehensive risk management practices enhances corporate agility. By aligning strategies with the evolving economic environment, businesses can protect shareholder value, sustain growth trajectories, and respond effectively to both domestic and international inflationary pressures.

Conclusion: Navigating the UK Inflation Impact

The UK Inflation Impact is a critical factor shaping interest rates, market behavior, personal finance, and corporate strategy. Understanding its implications allows stakeholders to make informed decisions, optimize investments, and adapt proactively to economic changes. Engaging with expert analyses, monitoring policy developments, and leveraging actionable insights are key to navigating inflationary environments successfully.

For further in-depth analysis on economic trends and implications, readers can explore our internal resources here: Economic Analysis Mauritius. Additionally, authoritative external insights are available via Bank of England – Inflation Report, offering valuable guidance on interest rate decisions and inflation management.

In conclusion, navigating the UK Inflation Impact requires vigilance, strategic planning, and informed decision-making. By understanding the multifaceted effects on markets, businesses, and personal finances, stakeholders can respond effectively to challenges and leverage opportunities presented by evolving economic conditions.