Understanding the Financial Context

The financial sector in Mauritius is undergoing significant transformation, driven by global economic trends, regulatory changes, and evolving client expectations. Within this shifting landscape, AAMIL Group has established itself as a leader in building trust and fostering confidence among investors, clients, and partners. By prioritizing transparency, ethical practices, and responsive strategies, AAMIL Group demonstrates how a financial institution can navigate change while maintaining credibility.

AAMIL Group’s approach emphasizes understanding both macroeconomic factors and micro-level client needs. This dual focus ensures that strategic decisions are informed by market dynamics and aligned with stakeholder expectations. In a sector where trust is a critical currency, the group’s commitment to reliability and clear communication distinguishes it from competitors and reinforces long-term relationships.

Additionally, AAMIL Group invests in continuous monitoring of financial trends and regulatory frameworks. By staying ahead of policy shifts and market volatility, the group can proactively adjust strategies, minimize risks, and provide accurate guidance to clients. This proactive stance strengthens confidence and ensures that stakeholders perceive the organization as stable, knowledgeable, and trustworthy.

Core Strategies for Building Trust

AAMIL Group employs several key strategies to cultivate trust within a dynamic financial environment. First, transparency in reporting and operations ensures that clients and investors have clear visibility into financial performance, risk management, and compliance practices. Second, robust governance structures promote accountability and reinforce ethical standards across all levels of the organization. Third, client-centric services prioritize responsiveness, reliability, and personalized solutions.

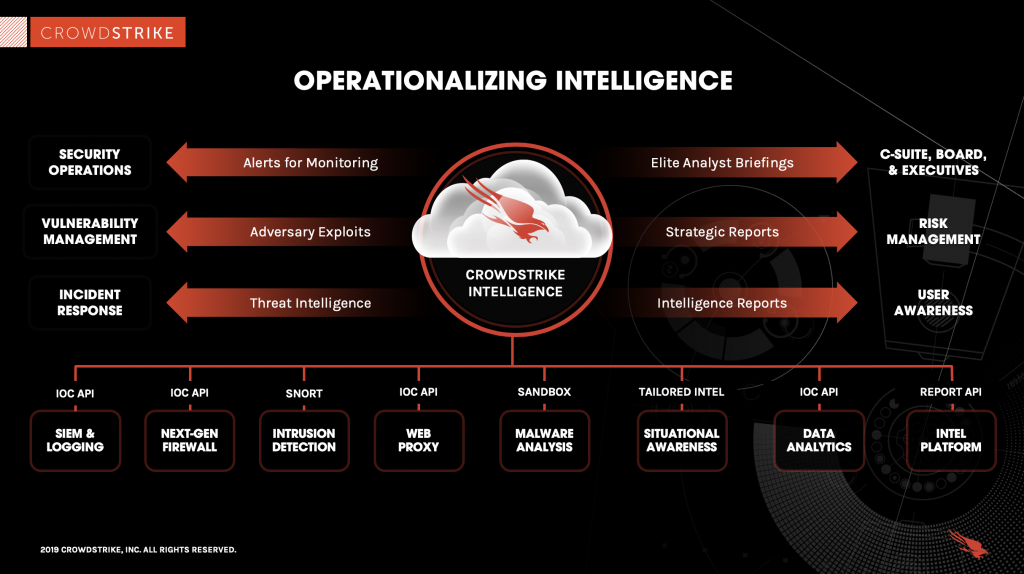

The group also leverages technology to enhance trust. Digital platforms for secure transactions, real-time reporting, and seamless communication allow stakeholders to access information efficiently and confidently. By integrating technological solutions with traditional financial expertise, AAMIL Group strengthens credibility and reduces uncertainty in client interactions.

Furthermore, AAMIL Group emphasizes staff training and professional development as a pillar of trust-building. Knowledgeable, ethical, and competent personnel are essential for delivering consistent quality and maintaining client confidence. Through a combination of governance, technology, and human capital investment, the group ensures a comprehensive approach to fostering trust in a rapidly evolving market.

Navigating Change and Uncertainty

In a financial sector characterized by rapid changes and unpredictable market dynamics, AAMIL Group’s resilience and adaptability stand out. The organization continuously evaluates market trends, regulatory updates, and competitor strategies to make informed decisions. This proactive approach allows the group to mitigate potential risks and capitalize on emerging opportunities while maintaining stakeholder confidence.

AAMIL Group also focuses on scenario planning and risk assessment, ensuring that strategies are robust under various conditions. By preparing for potential disruptions, the group demonstrates reliability and foresight, qualities essential for sustaining trust in the financial community. Clients and investors recognize the value of this preparedness, which strengthens long-term partnerships and reinforces market stability.

Finally, AAMIL Group encourages open dialogue with clients, regulators, and partners to foster collaborative problem-solving. Regular consultations, feedback mechanisms, and advisory services allow the organization to respond effectively to concerns, build consensus, and maintain transparency. This engagement not only enhances trust but also positions AAMIL Group as a thought leader in Mauritius’ evolving financial landscape.

Strengthening Client Relationships

AAMIL Group places significant emphasis on building and maintaining strong client relationships. Personalized attention, transparent communication, and proactive support are central to the group’s client engagement strategy. By understanding the unique needs of each client, AAMIL Group can offer tailored solutions that foster loyalty and confidence, ensuring long-term partnerships even in uncertain economic conditions.

Regular client reviews and feedback mechanisms allow the organization to assess satisfaction levels, anticipate emerging concerns, and adjust strategies accordingly. This client-centric approach reinforces trust and demonstrates AAMIL Group’s commitment to delivering consistent value. In competitive financial markets, such relationships are not only a differentiator but also a stabilizing factor for business continuity.

Additionally, AAMIL Group leverages advanced CRM systems and digital communication platforms to enhance client interactions. These tools allow for efficient tracking of client needs, rapid response to inquiries, and seamless collaboration across departments. By integrating technology with personal engagement, the group ensures that clients experience both professionalism and accessibility.

Governance and Compliance Excellence

Robust governance and strict compliance are cornerstones of AAMIL Group’s strategy to maintain trust. The organization adheres to national and international financial regulations, implements internal audit mechanisms, and maintains clear reporting standards. This ensures that all operations are conducted ethically and transparently, reinforcing stakeholder confidence and safeguarding the group’s reputation.

Staff are regularly trained on compliance protocols and ethical conduct, embedding a culture of accountability throughout the organization. By proactively monitoring regulatory changes and aligning operations with best practices, AAMIL Group minimizes risk exposure and demonstrates responsibility to clients, investors, and regulators alike.

Furthermore, governance excellence extends to strategic decision-making processes. Boards and committees operate with clear mandates, oversight responsibilities, and structured review systems. This level of organizational rigor reassures stakeholders that the group is well-managed, forward-looking, and capable of navigating the complexities of a transforming financial sector.

Innovation and Digital Transformation

Innovation and digital transformation are central to AAMIL Group’s strategy for building trust in a rapidly evolving financial market. By adopting advanced financial technologies, cloud solutions, and secure data management systems, the group enhances operational efficiency, transparency, and service delivery. Digital tools also enable real-time insights and accurate reporting, which are critical for investor confidence.

AAMIL Group encourages continuous improvement and experimentation with new technologies to meet client expectations and respond to market disruptions. Implementing innovative solutions allows the organization to maintain relevance, demonstrate forward-thinking leadership, and strengthen its reputation as a trustworthy financial partner.

Finally, by integrating digital platforms with personalized advisory services, AAMIL Group ensures that technological advancements complement human expertise. This balance between innovation and personalized attention is essential for cultivating long-term trust and maintaining resilience in a shifting financial landscape.

Future Outlook and Strategic Insights

Looking ahead, AAMIL Group remains committed to building trust and confidence as the financial landscape continues to evolve. By staying attuned to market developments, regulatory shifts, and client expectations, the group positions itself to anticipate challenges and capitalize on opportunities. Strategic planning, proactive risk management, and continuous engagement ensure that AAMIL Group maintains its reputation for reliability and professionalism.

The organization also focuses on expanding advisory capabilities, investing in digital infrastructure, and fostering innovation to meet the changing demands of the financial sector. These efforts not only strengthen internal operations but also enhance stakeholder confidence, demonstrating that AAMIL Group is prepared for long-term sustainability and growth.

Conclusion: AAMIL Group as a Benchmark for Financial Trust

AAMIL Group exemplifies how a financial institution can navigate a shifting market while maintaining credibility and trust. Through governance excellence, client-centric strategies, digital innovation, and proactive market engagement, the group provides a model for SMEs and financial organizations aiming to build confidence and resilience.

For more insights into Mauritius’ financial sector and best practices, explore our coverage here: Economic Activity Mauritius.

For global perspectives on financial trust and corporate strategies, see: PwC – Financial Insights.