Why Understanding This Concept Matters Now

Bitcoin Investment: The global economy is teetering on the edge of transformation, with Bitcoin emerging not just as a digital currency but as a survival mechanism in turbulent financial times. For millions, navigating the complexities of inflation, debt, and currency devaluation requires tools that are borderless, decentralized, and resilient. This is where Bitcoin steps in—particularly in regions like Africa and Latin America—offering more than just value storage; it offers hope. In this article, we explore why “Bitcoin fiscal storms” isn’t just a phrase, but a forecast that demands serious attention.

The Growing Fiscal Instability Around the World

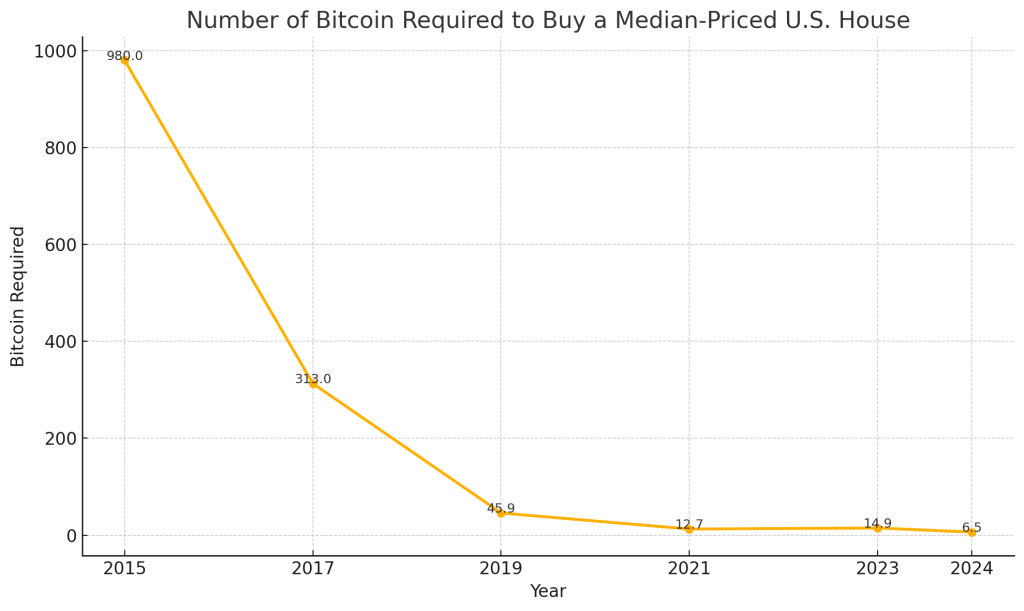

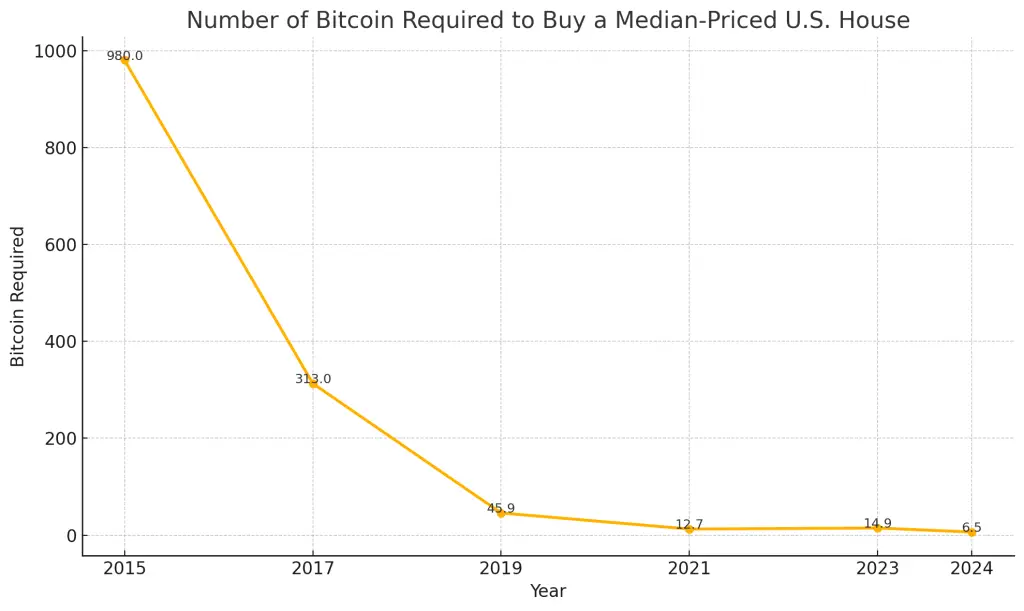

From rising inflation rates in developed economies to chronic debt in developing nations, fiscal instability is spreading fast. Governments are printing money at unprecedented rates, devaluing national currencies, and increasing the risks of long-term financial collapse. Bitcoin, in contrast, remains capped at 21 million coins, offering a fixed supply immune to political manipulation. This mathematical scarcity positions Bitcoin as a potential hedge against fiat collapse.

Bitcoin as a Shield for Personal Wealth

For everyday individuals, preserving wealth during economic downturns is a daunting task. Traditional assets like stocks or real estate are often out of reach or volatile. Bitcoin provides a portable, divisible, and borderless asset that can be stored on a USB stick or memorized as a seed phrase. This accessibility empowers individuals in economically unstable countries, especially those with capital controls or hyperinflation, to protect their savings. As Mauritius Biz Monitor has analyzed in several reports, the adoption of crypto tools is accelerating among small investors.

Bitcoin Investment : Regulatory Winds are Shifting

Initially, many countries tried to ignore or suppress Bitcoin through restrictive regulations. But the narrative is changing. With major institutions like BlackRock and Fidelity entering the Bitcoin ETF space, a shift in perception is evident. More governments are warming up to Bitcoin as a legitimate asset class. These changes could create more favorable conditions for the average citizen to adopt Bitcoin legally and securely. Meanwhile, developing countries are crafting their own regulatory frameworks to enable inclusion.

Bitcoin Investment: Integrating Bitcoin in Financial Strategy

Smart investors and households are now including Bitcoin in their broader financial plans. It’s not about going “all-in,” but rather diversifying against potential systemic collapse. With hardware wallets, cold storage, and peer-to-peer exchanges, there are multiple ways to integrate Bitcoin safely. Learning how to balance this asset within traditional savings plans is essential. Financial literacy is becoming more crypto-oriented—and rightly so.

Bitcoin Investment: Why This Matters for Mauritius and Beyond

As an emerging fintech hub, Mauritius must pay attention to these global signals. With its ambition to become a financial gateway between Africa and Asia, embracing decentralized finance could be a catalyst for innovation. Platforms like Mauritius Biz Monitor are essential in educating the public and policymakers on the implications of the crypto movement. As global fiscal storms approach, Bitcoin may be the life raft the region needs.

Why Bitcoin Investment Matters Today

Bitcoin investment has become a key financial strategy for individuals and institutions seeking to hedge against inflation and diversify their portfolios. With traditional markets facing volatility, more people are turning to cryptocurrencies as a reliable store of value. Understanding the dynamics of Bitcoin investment is essential in today’s rapidly evolving financial landscape, where digital assets play a growing role in shaping the future of wealth.

Source: BitcoinMagazine.com